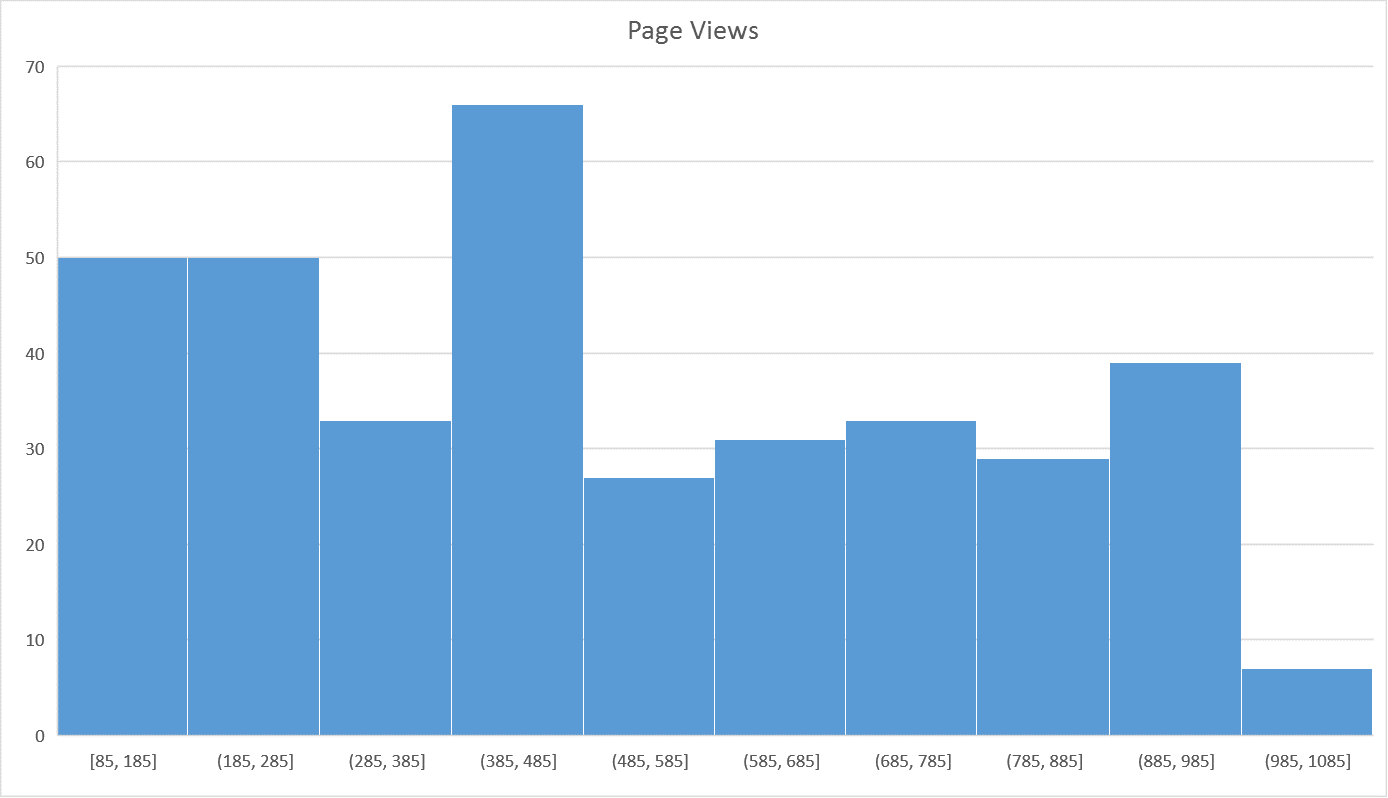

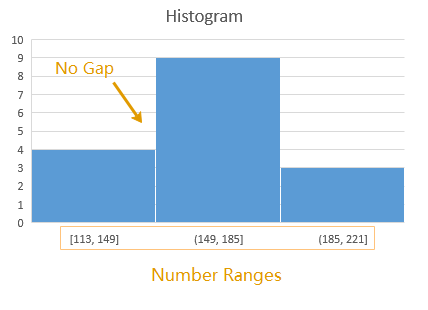

After creating a line using the Bins column for the X Values and Count or Scaled column for the Y Values, add Y Error Bars to the line that extend down to the x-axis (by setting the Percentage to 100%). However, you CAN use a scatter plot to create a histogram. This can make it very difficult to overlay data that uses a different number of points or to show the proper scale when bins are not all the same size. One of the problems with using bar charts and area charts is that the numbers on the x-axis are just labels. Then go to the Options tab and reduce the Gap. Tip: To reduce the spacing between the bars, right-click on the bars and select " Format Data Series.". To create the histogram, just create a bar chart using the Bins column for the Labels and the Count or Scaled column as the Values. You do it: Step 1: Create an array of bins Reasons I like this method is that you can make the histogram dynamic, meaning thatĮvery time you re-run the MC simulation, the chart will automatically update. This is the method used in the spreadsheet for the sales forecast example. Method 2: Using the FREQUENCY function in Excel. AND, you still need to create an array of bins (which This is probably the easiest method, but you have to re-run the tool each to youĭo a new simulation. Method 1: Using the Histogram Tool in the Analysis Tool-Pak. Another simple way to achieve this is to use Pivot Tables > Grouping option. You can use either formulas or data analysis tools to achieve this. You just need an intermediate step to convert raw data to frequencies by bin. If you do not have Excel 2016, you can still create histograms.

#HOW DO YOU ENTER THE DATA FOR A HISTOGRAM IN EXCEL 2016 HOW TO#

Update 7/2/15: A Histogram chart is one of the new built-in chart types in Excel 2016, finally! ( Read about it). How to make histograms in older versions of Excel. To skip ahead to the next step in our analysis, move on to Summary Statistics, or continue reading below to learn how to create the histogram in Excel. The histogram tells a good story, but in many cases, we want to estimate the probability of being below or above some value, or between a set of specification limits.

The last step is to analyze the results to figure out how much the profit might be expected to vary based on our uncertainty in the values used as inputs for our model.

0 kommentar(er)

0 kommentar(er)